Investment

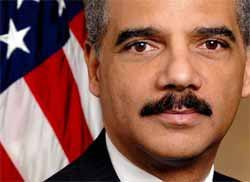

Will Eric Holder’s Deal Create a New Mortgage Crisis?

It seems Attorney General Eric Holder has created a multi-million dollar backdoor kickback for activist groups in the $13 billion JP Morgan Chase subprime loan deal recently settled, WND reports.

It seems Attorney General Eric Holder has created a multi-million dollar backdoor kickback for activist groups in the $13 billion JP Morgan Chase subprime loan deal recently settled, WND reports.

It appears the Obama administration has a strategy for reviving subprime mortgage lending by coercing banks to fund community organizing groups that may once more put low-income families into mortgages beyond their means.

“Annex 2” of the settlement agreement mandates that JPMorgan hand over “any unclaimed or unpaid damages to a nonprofit group that finances Acorn clones and other shakedown groups,” Investor’s Business Daily noted in a recent editorial.

The settlement agreement forces JPMorgan to hand over $4 billion in consumer relief designed to help consumers who were hurt by its packaging of subprime mortgages into securities.

JPMorgan agreed to pay under the Home Affordable Modification Program and Making Home Affordable Program, two programs from the Obama administration designed to get mortgages for low-income households. The programs do so through loan modification programs, mortgage loan forgiveness and targeted programs meant to “relieve urban blight.”

If the government finds that a shortfall in obligation remains by December 31, 2017, the agreement also states that JPMorgan must make a payment in cash equal to the shortfall to NeighborWorks America for foreclosure prevention, housing counseling, and neighborhood stabilization.

This means potentially billions of dollars may be distributed to Democratic activists through the government-funded NeighborWorks, which supports a network of leftist community organizers similar to the disgraced Acorn.

In 2011, NeighborWorks paid out $35 million in grants to 115 of these groups, including Affordable Housing Alliance, which puts pressure on big banks to make risky loans in low-income areas.

While the recession slowed funding for these groups, this massive deal from Holder may hold the answer to rebuilding their cash supplies quickly.

This back-door funding has also been written into the wording of other major deals brokered by Holder, including the $335 million settlement with Bank of America over subprime mortgages, according to IBD. Banks must turn over leftover money in escrow to Democratic affordable housing groups.

Does this mean that lenders will be paying for the same groups who caused the risky loans that created the mortgage crisis? With a new, large supply of cash, they may be able to step up their campaign once more to repeat the cycle of dangerous lending.

The settlement also requires JPMorgan to donate foreclosed homes to these groups and provide mortgages to low- and moderate-income borrowers hurt the most by subprime foreclosures. The areas targeted include Miami, Detroit, Atlanta and Chicago.

Holder alleged that JPMorgan “misled investors” in the subprime mortgage securities. Still, this deal will only benefit the deadbeat borrowers, not the investors that were misled. In many ways, this deal appears to be no more than an anti-poverty campaign that benefits Democratic strongholds hurt the most by foreclosures.