Analyst Insights

Shifts in Global Smartphone Market: Samsung Reclaims Lead as Apple Faces Decline and Chinese Brands Surge

A recent IDC report highlights that the global smartphone market grew by 7.8% to 289.4 million units in the first quarter of 2024, marking the third consecutive quarter of growth despite ongoing macroeconomic challenges. This indicates a positive recovery trend in the industry.

The recovery is also shifting market dynamics, leading to changes in consumer behavior and the strategic positioning of top companies. While the top players, particularly Samsung, are navigating these changes successfully, the overall market landscape is evolving, with smaller brands struggling to maintain their market position.

Samsung Electronics (KOSE: 005930) reclaimed the top spot as the leading smartphone vendor, overtaking Apple Inc. (NASDAQ: AAPL) which led at the end of 2023.

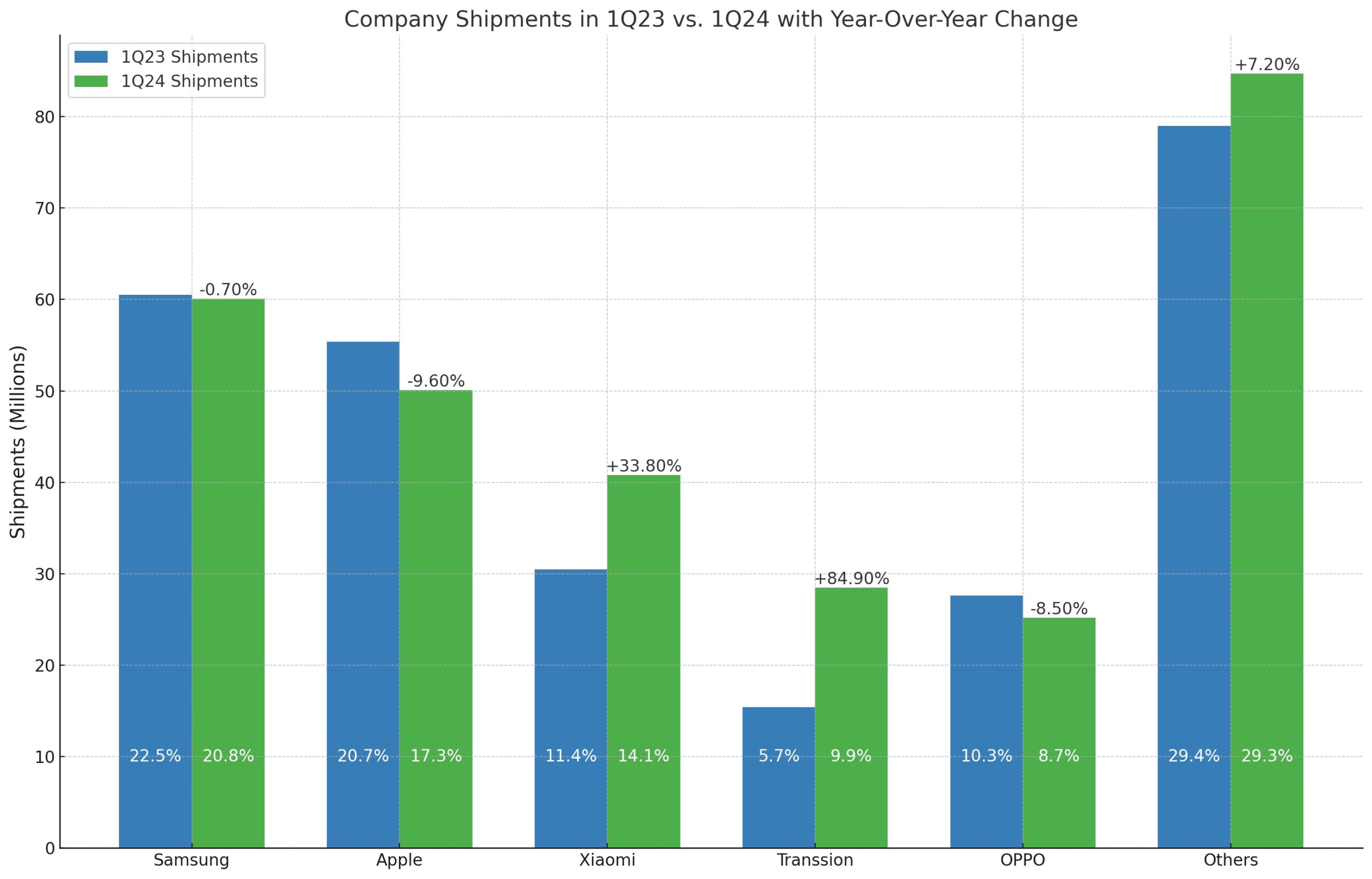

Samsung captured a 20.8% market share with shipments holding steady at 60.1 million units. Despite this, Samsung’s market share has slightly decreased from 22.5% in the same quarter of the previous year.

The competitive pressure from Chinese manufacturers, notably BBK Electronics (private), Huawei (private), Transsion (SHSE:688036), and Xiaomi (SEHK:1810), are reshaping the market dynamics, impacting the market shares of established leaders like Apple and Samsung. BBK is one of the largest manufacturers of smartphones in the world and sells its mobile devices under the brand names OnePlus, Oppo, Realme, and Vivo.

Apple’s Strategic Challenges and Opportunities

Apple’s performance in the first quarter of 2024 shows a significant downturn, with iPhone shipments declining by nearly 10% year-over-year. The company shipped 50.1 million units during this period, a drop from 55.4 million units in the first quarter of 2023.

This decline is the steepest among the top five smartphone manufacturers, contributing to a reduction in Apple’s market share from 20.7% to 17.3% year-over-year.

As the smartphone market evolves, Apple faces strategic challenges, particularly in China, where competition is intensifying. The growth of Huawei and other local brands has been at the expense of Apple’s market share.

Apple’s declining performance in China is also influenced by broader geopolitical tensions, which have resulted in restrictions on the use of Apple devices within certain Chinese companies and government agencies. This mirrors the U.S. government’s restrictions on Chinese apps, reflecting the broader U.S.-China technological and trade frictions.

The Rise of Chinese Manufacturers

Chinese smartphone manufacturers have shown impressive growth, challenging the dominance of incumbents like Apple and Samsung:

- Xiaomi’s shipments surged by 33.8% to 40.8 million units.

- Transsion, known for its Tecno, Itel, and Infinix brands, saw an 84.9% jump in shipments, reaching 28.5 million units and solidifying its position as the world’s fifth-largest smartphone manufacturer.

- Oppo experienced a decline, with shipments falling by 8.5% to 25.2 million units.

Huawei’s Market Resurgence

Huawei’s resurgence in China has been particularly notable, especially following the launch of its Mate 60 smartphone, which has received a strong consumer response. This resurgence is part of a broader recovery and repositioning strategy that Huawei has embarked upon, amidst ongoing global market shifts.

Future Outlook and Industry Implications

Looking forward, the smartphone market is likely to see continued shifts in competitive dynamics, with the top brands seeking new areas for expansion and differentiation. While Samsung has regained its lead, the rise of Chinese manufacturers poses new challenges to incumbents like Apple.

Apple’s upcoming Worldwide Developers Conference (WWDC) is anticipated to reveal significant updates, possibly around artificial intelligence capabilities, which could influence its competitive stance.

The ongoing industry recovery, coupled with strategic realignments and technological advancements, will likely influence future market dynamics significantly.

Moreover, the broader industry trends suggest a continued push towards higher-value devices, with consumers opting for more expensive models that they intend to use over longer periods.

Investors and market observers will need to closely monitor these developments, as they will define the competitive landscape and growth trajectories of key market players in the coming periods.

Figure 1: Worldwide Smartphone Shipments, Market Share, and Year-Over-Year Growth, Q1 2024

Source: IDC Quarterly Mobile Phone Tracker, April 15, 2024

Top Smartphone Manufacturers

The top smartphone manufacturers include a mix of well-established and rising companies from various regions, particularly strong showings from Asian manufacturers. The list includes:

- Samsung Electronics (KOSE: 005930): Samsung continues to lead globally with a wide range of consumer and business electronics.

- Apple Inc. (NASDAQ: AAPL) – Apple remains a dominant player in the market and is known for its premium devices and strong brand value.

- Huawei (private): Despite facing significant challenges due to international trade restrictions, Huawei continues to perform well, especially in the Chinese market.

- Xiaomi Corporation (SEHK: 1810): Gaining ground with aggressive pricing and robust market expansion, especially in emerging markets.

- Transsion Holdings (SHSE: 688036): Transsion is recognized for its strong market presence in Africa and now ranks among the world’s largest smartphone vendors. The company has seen significant growth, not only maintaining its dominance in African markets but also increasing its market share globally, notably in the Philippines and other emerging markets.

- BBK Electronics (private): BBK is one of the largest manufacturers of smartphones in the world and sells its mobile devices under the brand names OnePlus, Oppo, Realme, and Vivo.

- OnePlus: OnePlus is recognized for its premium build quality and high-end specifications at competitive prices.

- Realme: A newer but rapidly growing brand is known for its value-for-money offerings.

- Oppo: Oppo is known for its strong presence in the mid-range market.

- Vivo: Vivo is noted for innovative camera technologies and significant market share in Asia.

- Motorola Mobility LLC (a Lenovo company): Motorola Mobility operates as a subsidiary of Lenovo Group (SEHK: 992). Motorola Mobility is known for its wide range of products from budget to high-end.

- Nokia Oyj (HLSE: NOKIA): Although not as dominant as it once was in the market, Nokia continues to offer a range of devices across various market segments.

- Sony Group Corporation (TSE: 6758): Sony has shifted its focus to niche markets within the smartphone industry, concentrating on premium multimedia devices that leverage its strengths in camera and display technology.

- HTC Corporation (TWSE: 2498): Once dominant in the market, HTC has reduced its smartphone operations and focuses more on niche markets and virtual reality integration.

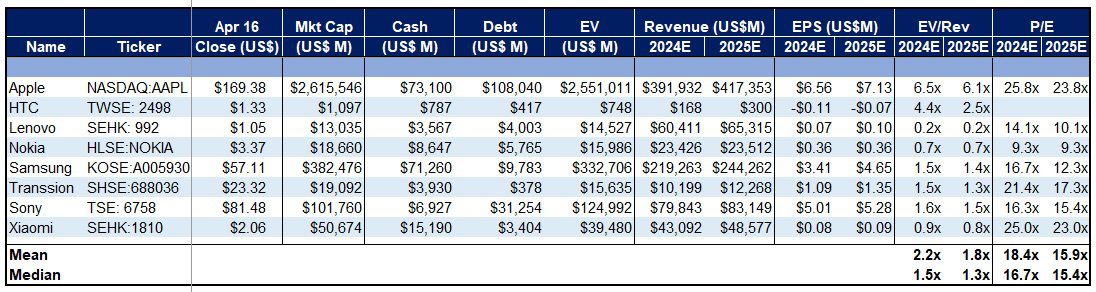

Figure 2: Publicly-Traded Smartphone Manufacturers

Source: S&P Capital IQ; eResearch Corp.

DISCLAIMERS: Unless specified otherwise, all financial figures are presented in United States Dollars (USD). Conflict of Interest Disclosure: The author of this report, along with employees, consultants, and family members of US Financial Post, may hold stock positions in the companies discussed. Additionally, they may have received compensation from any company mentioned in this report or article. Accuracy and Completeness: US Financial Post does not guarantee the accuracy or completeness of the information provided in this article. The content on usfinancialpost.com is intended solely for general informational purposes and should not be regarded as financial, investment, tax, legal, or accounting advice. It also does not constitute an offer or solicitation to buy or sell any securities mentioned. Consultation Recommended: Investment decisions should be based on individual circumstances and current market conditions. Readers are advised to consult with a financial advisor before making any investment decisions based on the information in this article. Forward-Looking Statements: This article may contain forward-looking statements as defined under applicable securities laws. These statements are based on the opinions and assumptions of the Company’s management as of the report’s date and are subject to various risks and uncertainties. Such uncertainties could cause actual events or results to differ significantly from those projected in the forward-looking statements. It’s important to note that additional risks, including those unknown or deemed immaterial now, could adversely affect the Company’s business and the value of its securities. Projection Disclaimer: Any projections provided are intended as goals rather than guarantees. They are based on assumptions that may not prove accurate. A potential decline in the Company’s financial condition or operational results could adversely impact the value of its securities.