Analyst Insights

Palo Alto Networks FQ4 Earnings Exceed Consensus with a Positive Outlook for 2024

Palo Alto Networks, Inc. (NASDAQ: PANW), a leading name in cybersecurity, recently released its financial results for the fiscal fourth quarter of 2023, ending July 31, 2023.

Results indicated a strong performance, surpassing consensus revenue and earnings estimates

Revenue Up 26%

Palo Alto reported a significant increase in its revenue for the fiscal fourth quarter. Revenue in the quarter was $1.95 billion, up 13.5% from $1.72 billion in the previous quarter, and up 26% from $1.55 billion in the same quarter last year. However, quarter revenue was in-line with analysts’ consensus estimates.

For the fiscal year 2023, revenue was reported between product sales and subscription services: product revenue was reported at $1.578 billion, while subscription and support services brought in $5.314 billion.

Earnings Beat the Consensus

The company’s adjusted earnings for the three months ending in July rose 80% rise from the previous year, reaching $1.44 per share.

Earnings were higher than consensus, which had estimated earnings of $1.29 a share.

The Cybersecurity Landscape

Chief Executive Nikesh Arora emphasized the robust nature of the cybersecurity market, predicting its continued strength for the next two to five years.

The cybersecurity industry is witnessing a period of rapid growth and evolution. As technology spending accelerates, cybersecurity is expected to claim a significant portion of this growth.

This trend is driven by the increasing digital threats and the ever-growing importance of data security in today’s digital age.

A Positive Outlook for 2024

Palo Alto remains optimistic about its future performance. The company has expected its billings for the fiscal year 2024 to be in the range of $10.9 billion to $11 billion.

Furthermore, the company anticipates its revenues to lie between $8.15 billion and $8.2 billion. Such projections indicate the company’s confidence in its growth trajectory and its ability to capitalize on market opportunities.

Addressing the Unusual Release Time

In an interesting turn of events, Palo Alto Networks chose a rare after-market release time for their earnings report. The company explained this decision as a means to provide analysts ample time for one-on-one discussions over the weekend.

This was also strategically timed ahead of a company-wide sales conference scheduled for Sunday. While this move was unconventional, it underscores the company’s commitment to transparency and stakeholder engagement.

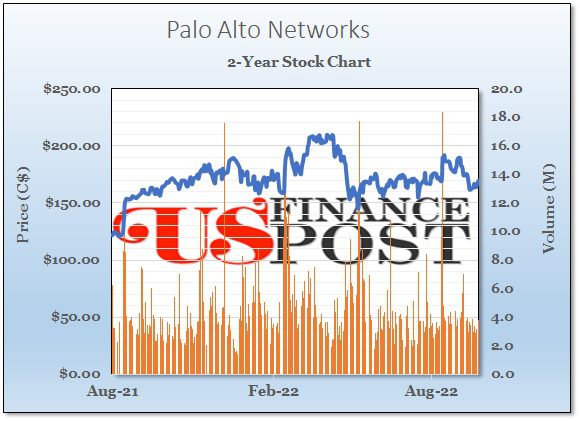

Palo Alto (NASDAQ: PANW)

Headquartered in Santa Clara, United States, Palo Alto is a platform-based cybersecurity vendor that provides network security, cloud security, and security operations to enterprises, service providers, and government entities. The company was founded in March 2005 and has more than 85,000 customers across the world, including more than three-fourths of the Global 2000.

Palo Alto is currently trading at $241.66 with a market cap of $73.9 billion.

Source: Data from S&P Capital IQ