Advice

Navigating Bitcoin’s Volatility

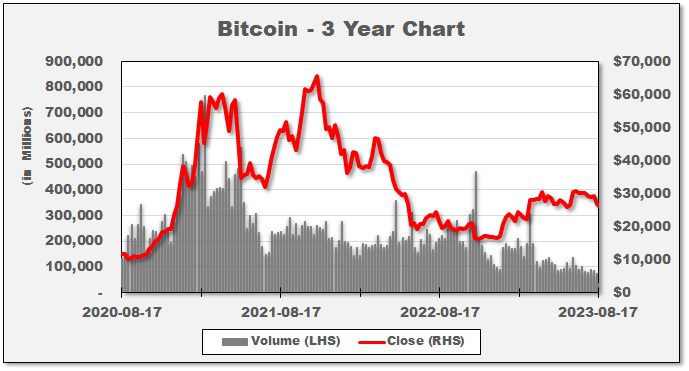

The realm of cryptocurrencies, known for its rapid shifts and unpredictability, recently experienced a series of events that have reverberated across the cryptocurrency investment landscape.

In a matter of days, Bitcoin’s value plummeted, triggering a cascade of reactions in the digital asset market.

SpaceX’s Influence: A Catalyst for Market Ripples?

The cryptocurrency market was disrupted as news surfaced that SpaceX, under the helm of Elon Musk, had either written down or divested its Bitcoin holdings.

This rumor set off a domino effect, leading to a widespread selloff not only in Bitcoin but also in other major cryptocurrencies, including Ethereum and Dogecoin. Bitcoin’s value nosedived from around $29,000 to touch a two-month low of $25,314 within just 24 hours.

This news acted as a stark reminder of how influential players can significantly impact the dynamics of the digital asset market.

Cryptocurrency Investment Landscape

The shockwaves extended beyond the cryptocurrency realm, as Bitcoin-associated stocks, such as Coinbase Global, Inc. (Nasdaq: COIN), Marathon Digital Holdings, Inc. (Nasdaq: MARA), and Riot Platforms, Inc. (Nasdaq: RIOT), witnessed a retreat in their value.

The top 100 digital tokens index also experienced a substantial drop of over 5%. Notably, Ether, Cardano, and Solana echoed this trend, experiencing declines ranging from 2% to 3.2%.

This serves as a reminder of the interconnectedness of various sectors within the investment landscape, where cryptocurrency fluctuations can have a ripple effect on traditional financial instruments.

Cryptocurrency Challenges

Amid the upheaval, it’s noteworthy that Bitcoin’s year-to-date performance remains robust, boasting an impressive 60% gain. However, the road ahead is fraught with challenges.

Factors such as new regulations, recessionary pressures, and rising bond yields, all cast shadows on the broader adoption of cryptocurrencies as a reliable investment avenue and pose a threat to the allure of digital assets.

Final Thoughts

As investors navigate the resultant market turbulence, they are acutely focused on Bitcoin’s critical $25,000 level. A breach below this point could unleash further rounds of liquidation, intensifying downward pressure.

With limited immediate catalysts for Bitcoin’s price resurgence, investors are urged to approach the situation with vigilance and adaptability.

While Bitcoin’s endurance is evident over the long term, short-term market challenges cannot be ignored. As the relationship between cryptocurrencies and traditional financial markets intertwines, US investors must remain proactive and poised to harness opportunities while tackling uncertainties.

Source: Data from Yahoo!Finance