Business

$1.2T Infrastructure Bill To Be A Boon For These 12 Stocks

The passage of the $1.2T infrastructure bill could be a major boon to the following 12 stocks over the next 8 years.

The Bipartisan Infrastructure Deal (Infrastructure Investment and Jobs Act) was passed by Congress on November 6th, 2021, and signed into law by President Biden on November 15th, 2021, with the objective of:

- Easing inflationary pressures and strengthening supply chains by making long-overdue improvements to U.S.’s ports, airports, rail, and roads,

- Expanding access to clean drinking water,

- Ensuring every American has access to high-speed internet,

- Tackling the climate crisis,

- Advancing environmental justice,

- Investing in communities that have too often been left behind,

- Driving the creation of good-paying union jobs, and,

- Growing the economy sustainably and equitably so that everyone gets ahead for decades to come.

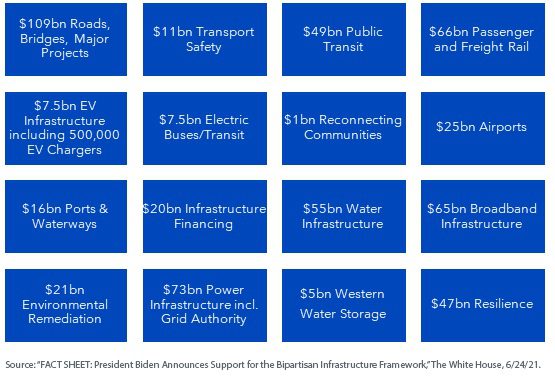

FIGURE 1: U.S. Infrastructure Bill Spending Plans

-

Brookfield Infrastructure Corporation (NYSE: BIPC)

- BIPC is one of the largest diversified infrastructure stocks in the world, with operations spanning utilities, transportation, energy, and data infrastructure.

-

Caterpillar (NYSE: CAT)

- CAT makes asphalt pavers, compactors, excavators, pipe layers, backhoes, and just about everything else you’d need for a major infrastructure project.

-

ChargePoint Holdings (NYSE: CHPT)

- CHPT builds customized charging stations and the $7.5 billion in the bill will be enough to deliver about 250,000 charging stations and this massive build-out should directly benefit ChargePoint.

-

Crown Castle International (NYSE: CCI)

- CCI is one of America’s leading wireless tower real estate investment trusts (REITs) and with mobile data usage growing at a blistering rate for the foreseeable future, Crown Castle is well placed to play that trend.

-

Deere (NYSE: DE)

- DE is a major producer of construction and forestry equipment, and specifically the equipment used in earthmoving and roadbuilding.

-

Eaton (NYSE: ETN)

- ETF is a major supplier of electrical components and systems and under the infrastructure bill wind and solar farms have to be integrated into the national grid, and that’s exactly what Eaton does.

-

Freeport-McMoRan (NYSE: FCX)

- FCX is one of the world’s largest copper miners and, with 43% of all copper mined used in building construction, 20% used in transportation equipment, electric vehicles using about 4x as much copper as traditional internal combustion vehicles, and the transition to renewable solar and wind energy using more than 4x as much copper as oil and gas use, such will require major investments in copper of which Freeport-McMoRan is a major supplier.

-

Martin Marietta Material (NYSE: MLM)

- MLM makes crushed sand and gravel products, ready-mixed concrete and asphalt, and paving products and services; magnesia-based chemical products for industrial, agricultural, and environmental applications; dolomitic lime for the steel and mining industries, and chemical products for use in flame retardants, wastewater treatment and assorted environmental applications which many of the infrastructure areas of emphasis will need.

-

Nucor (NYSE: NUE)

- NUE is the largest domestic steelmaker in North America and, as such, should benefit from the passage of the infrastructure bill.

-

Oshkosh (NYSE: OSK)

- OSK builds specialty trucks used in heavy construction projects as well as cement mixers, truck-mounted cranes, “cherry pickers” and other hydraulic lifting systems and, as the bill calls for the electrification of the federal vehicle fleet (contract to produce 165,000 new mail trucks) Oshkosh is ideally suited to benefit from such a requirement.

-

United Rentals (NYSE: URI)

- URI’s General Rentals segment rents out typical construction equipment such as backhoes, forklifts, earthmoving equipment, boom lifts, etc., while its Trench, Power, and Fluid Solutions segment rents out specialty equipment specifically designed for underground work and fluid treatment.

-

Vulcan Materials (NYSE: VMC)

- VMC is America’s largest producer of construction aggregates, which includes things like crushed stone, sand, and gravel. It’s also a major producer of asphalt and cement all of which will be needed in large quantities as the infrastructure projects commence.