Analyst Insights

Dollar Tree FQ1 Sales Growth Hampered by Family Dollar

Dollar Tree Inc. (NASDAQ: DLTR) reported a 4.2% increase in net sales to $7.63 billion for FQ1/2025, compared to the same quarter in the previous year but was 0.45% below analysts’ consensus of $7.67 billion.

The company reported a net income of $300.1 million, or $1.38 per share, for the three months ending May 4, a slight increase from $299 million, or $1.35 per share, a year earlier. Adjusted EPS was $1.43, in line with analysts’ consensus.

The company’s growth was due to a 1% increase in comparable sales across all its stores, which was influenced by two factors: a 2.1% increase in customer visits, and a 1.1% decrease in the average amount each customer spent.

The lower ticket size reflected weaker discretionary demand, notably within the Dollar Tree segment. Discretionary sales faced challenges, notably impacted by early Easter timing and adverse weather conditions, which affected traditional spring celebrations and related sales categories.

The financial metrics highlighted during the call also focused on performance within specific categories as consumables saw a respectable increase, despite challenging market conditions, while discretionary items lagged, particularly due to seasonal fluctuations.

Operational Adjustments and Challenges

During the quarter, Dollar Tree continued its operational optimization by closing 970 underperforming Family Dollar stores as part of a broader initiative to enhance profitability and streamline operations.

Dollar Tree is currently conducting a strategic review of its Family Dollar segment, considering a potential separation of the two entities to optimize their respective operational focuses and capital allocations.

Dollar Tree acquired Family Dollar in 2015 for approximately $9 billion. Since the acquisition, Family Dollar has faced ongoing competitive challenges in maintaining market share against its primary competitor, Dollar General (NYSE: DG).

This review is driven by the distinct market dynamics and performances of the Family Dollar and Dollar Tree segments. A separation could allow each brand to pursue tailored growth strategies that align more closely with their specific customer demographics and operational needs, potentially enhancing overall corporate value and performance.

The company also faced challenges related to inventory shrinkage, which has been an ongoing issue but showed signs of stabilization due to proactive measures taken.

On a positive note, the company is actively expanding its multi-price offerings, which involves incorporating items priced above the traditional $1.25 mark in approximately 3000 stores by year-end. This strategy diversifies the product mix and aims to increase average ticket sizes, which can potentially boost overall revenue. The rationale behind this is to attract a broader customer base, including higher-income shoppers, thereby increasing store traffic and sales volume.

Expansion Through Acquisitions

Furthermore, Dollar Tree has accelerated its expansion through new store openings and strategic acquisitions, such as acquiring leases for 170 stores from the bankrupt ’99 Cents Only’ chain, significantly enhancing its presence on the West Coast.

This move not only capitalizes on established locations but also provides the company with a cost-effective growth path by avoiding the expenses associated with constructing new stores.

These stores are expected to generate sales and profit margins above the company’s average, which could enhance Dollar Tree’s overall margins and profitability.

Future Outlook and Expectations

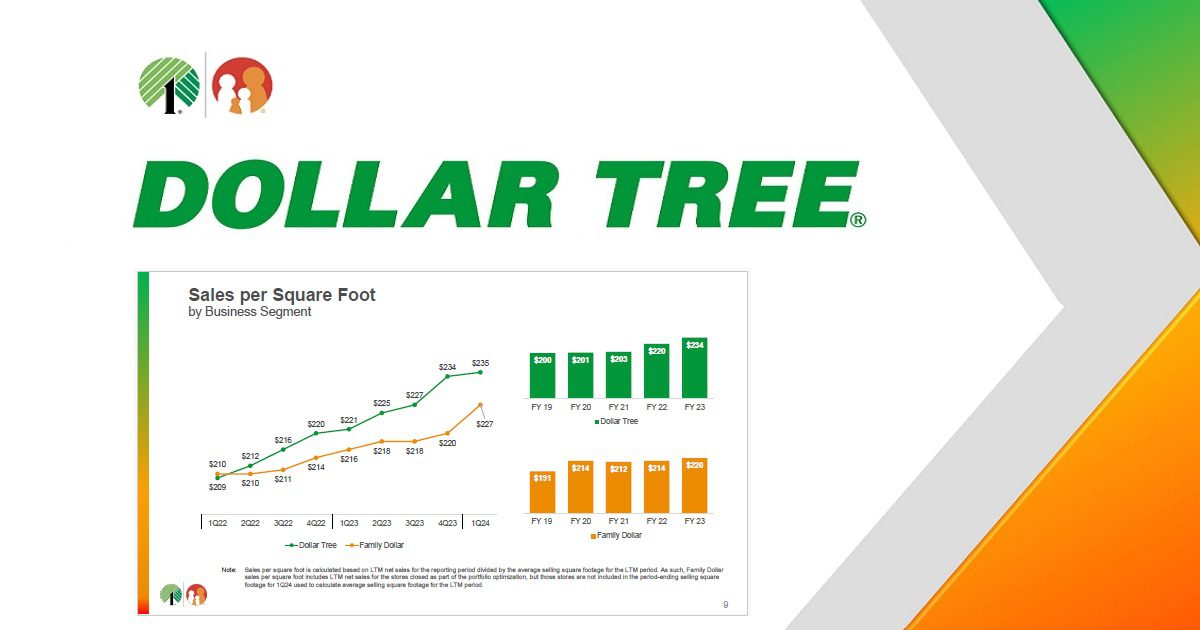

The company expects that its sales for the second fiscal quarter will be between $7.3 billion and $7.6 billion. It anticipates a sales growth of 2% to 4% for the Dollar Tree segment while expecting sales for the Family Dollar segment to remain relatively unchanged.

For the fiscal year 2025, the company anticipates continued sales growth, albeit potentially at the lower end of its previously stated range of $31 billion to $32 billion. The company remains cautious yet optimistic about its performance, considering the operational changes and broader market conditions.

The expected sales growth in the low to mid-single digits for Dollar Tree and low single digits for Family Dollar takes into account the operational changes and market conditions discussed.

Additionally, the company outlined potential impacts from ongoing operational costs related to the loss of their Marietta distribution center, estimating an EPS impact of $0.20 to $0.30 for the full year.

Analysts’ Rating and Price Targets

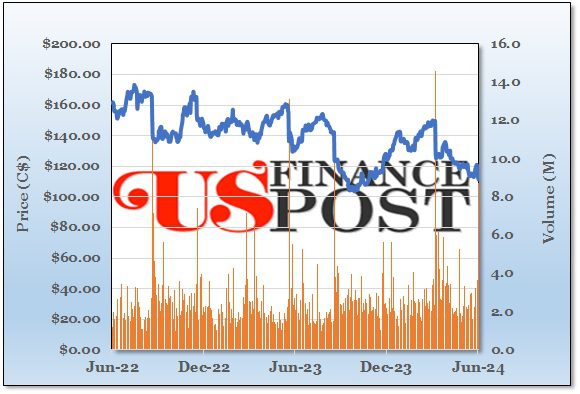

Last week, Citigroup downgraded Dollar Tree to Neutral from Buy, reducing the price target to $120 from $163. This adjustment reflects concerns about the ongoing struggles in turning around the Family Dollar business and suggests deeper structural issues than initially anticipated.

Telsey Advisory Group slightly lowered their price target for Dollar Tree from $160.00 to $155.00 but maintained an “outperform” rating, indicating a positive outlook despite recent challenges.

Morgan Stanley also revised their price objective, decreasing it from $135.00 to $130.00, and maintained an “equal weight” rating on the stock.

Meanwhile, Guggenheim continues to endorse a bullish stance with a “buy” rating and a $170.00 price target, while Piper Sandler is maintaining an “outperform” rating with a price target of $143.00.

Final Thoughts

Dollar Tree‘s recent financial results and strategic initiatives reflect a company actively navigating a complex retail environment with a clear focus on growth, operational efficiency, and market adaptation.

The company’s efforts to expand its product offerings, increase its retail footprint through acquisitions, and potentially restructure its operations underscore its proactive approach to overcoming industry challenges and capitalizing on emerging opportunities.

FIGURE 1: Dollar Tree – 2-Year Stock Chart

Source: Data from S&P Capital IQ